“It is impossible to produce superior performance unless you do something different from the majority”

Sir John Templeton

| 8 Year Track Record | Blue Ocean Odyssey have been implementing an equity hedge fund strategy since 2015. The Fund is focused on developed markets with major emphasis in the United States, United Kingdom and European equity markets. |

|---|---|

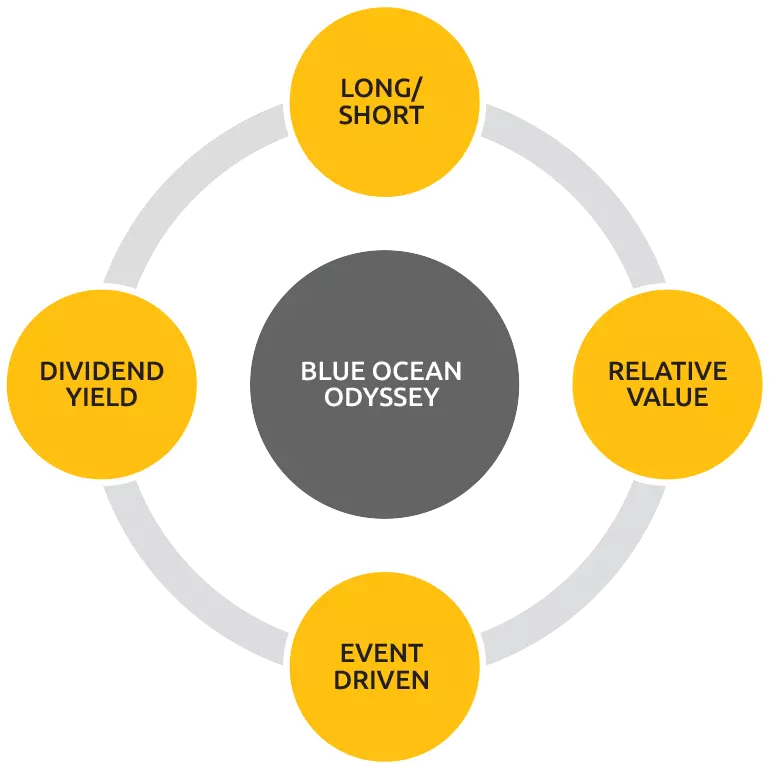

| Utilises Multiple Strategies | Blue Ocean Odyssey utilises multiple strategies including Long/Short, Merger Arbitrage, Dividend Yield, Relative Value and Event-Driven in order to maximize total absolute return, emphasizing investment in securities with short/medium term catalysts and capital appreciation prospects. |

| Concentrated Portfolio | Blue Ocean Odyssey aims to deliver attractive rates of return over a one to three year time horizon within a sufficiently concentrated portfolio of our best ideas. The Fund does not believe in capital allocation across multiple passive positions simply due to capital availability. We believe this results in dilution of our best investment ideas. The Fund is willing to remain in cash and strategically invest when our best ideas present themselves. |

| Holistic Market View | Blue Ocean Odyssey carefully monitors catalysts and events across all investments and actively hedges with options when appropriate. |

| Active Management | The Fund is actively managed and aims to harness our fundamentally driven, research focused investment process to drive alpha and to hedge risks accordingly. |

| Like-Minded Investors | Blue Ocean Odyssey looks for investors who share in our investment values and beliefs. |

Blue Ocean Odyssey believes in achieving superior long term risk adjusted returns by implementing a number of different strategies dependent on market conditions and opportunities

The Idea Generation process consists of narrowing the universe of equities to fit our investment profile. The Fund looks to narrow US, UK and European Equities, first into sectors and then into our multiple strategies.

Blue Ocean Odyssey likes to own great businesses that can compound shareholder value over time at reasonable valuations and will purchase good businesses at sharply discounted valuations based on our fundamental analysis and estimates of future earnings.

Following from the Investment Philosophy of capital preservation, Risk Management at Blue Ocean aims to protect the value of the Fund's investment portfolio against fluctuations in the securities markets, changes in interest rates, and other market and operational risks.

Blue Ocean Odyssey believes in active position management and a strong sale discipline. The Fund places an up-front emphasis on active portfolio management through a disciplined scaling approach and clearly defined exit parameters.

| Fund Name | Blue Ocean Odyssey Segregated Portfolio |

|---|---|

| Master Fund | Godolphin Fund SPC (Cayman Islands Based) |

| Investment Managers | Blue Ocean Odyssey Advisers Ltd |

| Asset Class | Equity |

| Bloomberg Ticker | BLUEOOD KY |

| ISIN | KYG4023A1397 |

| Fund Type | Open-Ended |

| InceptionDate | 1 March 2015 |

| Domicile | Cayman Islands |

| Fund Base Currency | USD |

| Subs/Reds Frequency | Monthly with 10 days notice for redemptions |

|---|---|

| Minimum Investment | USD 100,000 |

| Management Fee | 2% Per Annum |

| Fee Collection | Monthly in Arrears |

| Performance Fee | Paid Annually in Arrears: Up to 20% Return: 20% Fee; 20% and Above Return: 40%Fee |

| Exit Fees | 5% for Exits within the first 6 Months |

| Administrator | NAV Consulting, USA |

| Auditor | Deloitte & Touche, Cayman Islands |

Mihir's career spans 20 years in Investment Banking specialising in Global financial equities and convertibles as well as Asian and Eastern European Markets. He was the Founder-CEO of a London based investment bank with Global Brokerage, Corporate Finance and Asset Management operations in London when he led an investment advisory team. Mihir now uses his vast experience to manage the Godolphin Blue Ocean Odyssey Fund with a predominant focus on the US and European Equity Markets.

Dhaval has over 13 years of experience in Trading and Investment. His area of expertise includes arbitrage trading in equities, commodities and currency markets. He was managing AUM 75 million under Arbitrage Strategies in Edelweiss Financial Services for more than 8 years.

Bhargav has over 13 years of experience in trading and technical analysis His area of expertise includes trading in commodities, currencies and equities His experience includes trading arbitrage (equities and currencies), discretionary trading based on systematic algo trading

Professor Justin Stebbing is a distinguished personality in the field of Oncology and Cancer Medicine. He holds a PhD and FRCPath and is considered a leading light in his discipline. His career highlights include positions at renowned institutions such as Imperial College and the National Institute for Health and Care Research. Professor Stebbing's contributions extend beyond academia. He has an extensive collection of significant publications and has been involved in groundbreaking research, particularly in the development of Biosimilars and the repurposing of drugs for COVID-19 treatment. As an advisor to our Investment Committee, Professor Stebbing contributes his significant experience and knowledge in the Biotech, Pharma, and Healthcare sectors. His inputs and research provide a cutting edge to our fund management team.

Bam Azizi is the Co-founder and CEO of Mesh (aka Front Financial). Mesh powers the most secure way for fintech companies to transfer digital assets. Bam's first exposure to the finance industry was over a decade ago, when he founded cybersecurity and identity company, NoPassword. At NoPassword, Bam spent many years building identity services for large financial institutions. Through this experience, Bam realized the importance of fintech and how technology can improve the finance industry. Now, Bam is leveraging his expertise to transform the finance industry by changing how we connect and interact with our financial accounts.Bam has a PhD in computer science.

The above chart plots only the price change of the respective indexes / funds and does not include the dividends.

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Returns YTD (%) | |

| 2015 | 99.60% | 1.90% | -4.18% | -4.57% | -12.96% | -5.87% | 29.43% | 6.41% | -3.53% | 102.50% | |||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2016 | -20.47% | 19.78% | 13.59% | 3.42% | 3.95% | 4.99% | 1.05% | 0.93% | -0.85% | -10.97% | 2.69% | -0.21% | 12.69% |

| 2017 | 8.64% | -0.42% | -0.64% | -1.16% | 2.19% | 6.20% | -2.58% | -2.98% | -3.77% | -12.96% | 11.95% | 4.11% | 6.35% |

| 2018 | -5.28% | 4.42% | 2.02% | 8.43% | -6.71% | -2.95% | 2.65% | 0.60% | 4.30% | -8.22% | 7.49% | -22.59% | -18.54% |

| 2019 | 26.33% | 5.08% | 11.58% | 24.80% | -2.58% | 1.91% | -0.78% | -8.61 | -0.11% | 4.19% | 5.88% | -3.90% | 76.00% |

| 2020 | -15.26% | -6.20% | -10.95% | 36.76% | 14.25% | -5.82% | -11.99% | 18.39% | -2.75% | -1.23% | 16.24% | 22.43% | 48.37% |

| 2021 | -2.77% | -4.26% | 5.92% | -0.86% | 8.3% | 18.23% | 0.60% | 2.62% | 2.62% | 19.51% | -13.93% | 2.01% | 39.15% |

| 2022 | -4.24% | -10.17% | -2.82% | -15.06% | 5.95% | -15.98% | -2.43% | -11.98% | -9.10% | 3.16% | -3.04% | -6.58% | -53.49% |

| 2023 | 31.72% | 6.66% | 14.11% | 2.73% | -2.26% | 9.43% | 0.48% | -16.55% | -19.19% | -17.40 | 23.00% | 35.27% | 63.51% |

| 2024 | -9.74% | -8.37% | -2.92% | -7.07% | 14.42% | -9.08% | -17.68% | -14.30% | -13.17% | -3.70% | 14.78% | 5.02% | -44.94% |

| 2025 | 3.25% | -15.96% | -28.76% | 8.40% | 6.15% | 9.54% | 13.60% | -12.06% | 11.41% | 4.40% | -14.66% |